America Has A Major Misconception on Aging

According to SeniorCare.com, only a third or 37% of Americans think they WILL need Long-Term Care when in reality 69% of American actually WILL need Long-Term Care!

Did you know Senior Care includes more than Nursing Homes? There are more options available now then ever before to help your Senior reside at home as long as possible.

Projected Care Choices of Those Needing Long Term Care Image Source: https://www.seniorcare.com/featured/misconception-on-aging/graph.png Data Source: Long-Term Care Over an Uncertain Future (2006)

We research, match and assist our seniors with enrolling in managed care agencies, applying for public assistance programs, attending support groups, invitations to educational seminars, referrals to confident Elder Law Attorney and more!

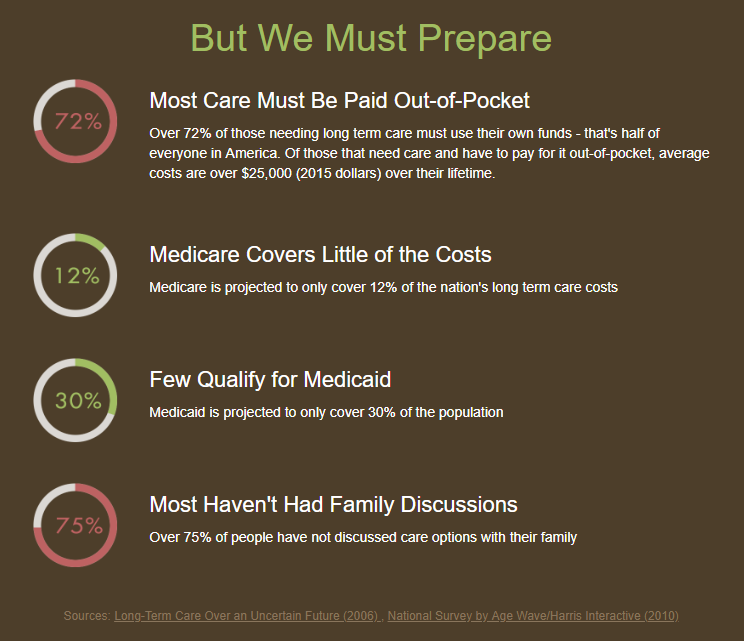

Image Source: https://www.seniorcare.com/featured/misconception-on-aging/

Sources: Long-Term Care Over an Uncertain Future (2006) , National Survey by Age Wave/Harris Interactive (2010)

SeniorCare.com asked 44 Industry Experts about the issue from leading organizations and companies, such as the American Health Care Association, The Scan Foundation, right at Home and BrightStar Care. Here are their Key Findings:

Why is there a drastic difference in people's perception vs reality?

- People are in denial over aging and what comes along with It.

- Consumers are optimistic in our youth-oriented culture. Why worry now anyway?

- People equate aging and long term care with death and defeat.

- The reality of aging is not a powerful enough motivator until it hits close to home.

- Care has been driven by crisis management versus proactive and preventative care.

- There is not enough discussion on what long term care is. It's not just "nursing homes".

"We all want to think that we will live forever and not need care. We will spend lots of time comparing wines, cars and homes, but not this."

-- Tami Neumann, Executive Producer and Host, Conversations in Care

What are the consequences for not being prepared?

- If you are prepared, you can choose the care you receive. If you are unprepared, care is chosen for you.

- Without proper preparation, the financial and emotional stress on the family to be the caregiver can be devastating.

- For the unprepared, the need for long term care can result in a complete depletion of assets and/or bankruptcy.

- Proper planning gives consumers control of their care options and also eases the burden of family members.

- Most people falsely believe Medicare will cover the costs of long term care services they will need.

- Most people don't have enough money to pay for long-term care out-of-pocket, but have too much to qualify for Medicaid.

"Social security won't save us, our kids won't house us, and our savings won't cover us. We risk state-institutionalization on a massive scale."

-- Rhonda Harper, Founder and CEO, Penrose Check-in Service

How would you close the discrepancy gap?

- The best long term care education comes from experience - when people have loved ones living the experience.

- Society, starting at a young age, needs to remove stigmas associated with aging. It's okay to admit natural aging.

- Long term care needs to get more mainstream media attention, and not just the risks, but the consequences of aging.

- Build more public awareness about aging and long term care through real life examples of people receiving and giving care.

- Human resource departments should address the need for long term care planning in addition to retirement planning.

- Consumers need to understand chronic diseases and make lifestyle changes to reduce the associated health risks.

"Working families need better tools to plan and pay for their future care needs, and this can only happen when there is a groundswell of public support and dialogue."

-- Dr. Bruce Chernof, CEO, The Scan Foundation

What advice do you have for consumers about their future care needs?

- Become your own advocate. Put together a plan that includes the proper legal and financial planning paperwork.

- Have consistent talks with your family about your long term care plan and maintain the ongoing dialogue.

- Build your team of trusted advisors that includes family members, financial planner, estate planning attorney, etc.

- Include long term care as part of your retirement planning. Begin saving and preparing for those needs.

- Knowledge is power. Seek input and advice from those with both positive and negative long term care experiences.

- Take care of yourself while you can. Make healthy choices to reduce risks and maximize your health.

"Get educated from multiple angles so you have all your bases covered. Build a team to protect your interests: Adult Children, Attorney, Accountant, Financial Planner, Doctors, Social Workers, Real Estate Agent... "

-- Lori La Bey, Founder, AlzheimerSpeaks.Com

When it comes to caring for our elder loved ones, most of us do not have a plan of action until there is an emergency situation that leaves us no other choice but to begin planning during very stress times. This is not from lack of love or commitment but lack of planning. Everyone should have the opportunity to create a plan based on their needs and future wishes.